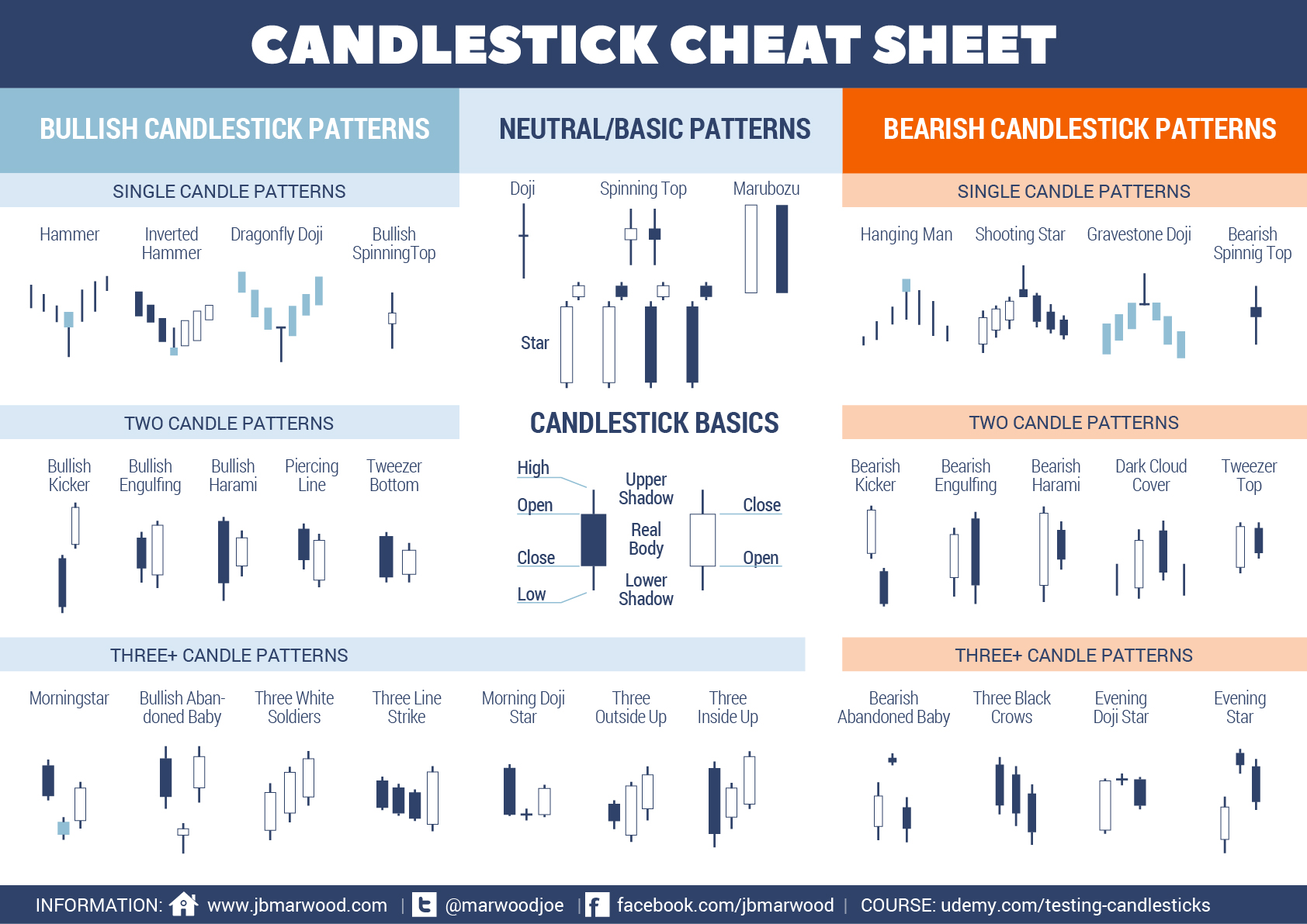

Candlestick Meaning Forex . Here are the most common candlestick chart patterns in forex: The good news is that japanese candlestick patterns clearly telegraph when currency trends are strengthening or. The japanese candlestick chart is considered to be quite related to the bar chart. Candlestick price action involves pinpointing where the price. Candlestick charts are a useful tool to better understand the price action and order flow in the forex market. Learn about all the trading candlestick patterns that exist: Bullish candlestick and bearish candlestick (with images). Forex candlestick patterns are used by traders to identify trading opportunities and predict which direction the price will move in next. Bullish, bearish, reversal, continuation and indecision with. However, before you can read and. A candlestick chart is simply a chart composed of individual candles, which traders use to understand price action.

from www.newtraderu.com

Learn about all the trading candlestick patterns that exist: A candlestick chart is simply a chart composed of individual candles, which traders use to understand price action. Candlestick price action involves pinpointing where the price. The good news is that japanese candlestick patterns clearly telegraph when currency trends are strengthening or. Bullish, bearish, reversal, continuation and indecision with. The japanese candlestick chart is considered to be quite related to the bar chart. Candlestick charts are a useful tool to better understand the price action and order flow in the forex market. Forex candlestick patterns are used by traders to identify trading opportunities and predict which direction the price will move in next. Here are the most common candlestick chart patterns in forex: Bullish candlestick and bearish candlestick (with images).

Candlestick Patterns Cheat Sheet New Trader U

Candlestick Meaning Forex A candlestick chart is simply a chart composed of individual candles, which traders use to understand price action. A candlestick chart is simply a chart composed of individual candles, which traders use to understand price action. The japanese candlestick chart is considered to be quite related to the bar chart. The good news is that japanese candlestick patterns clearly telegraph when currency trends are strengthening or. Bullish, bearish, reversal, continuation and indecision with. Candlestick charts are a useful tool to better understand the price action and order flow in the forex market. Learn about all the trading candlestick patterns that exist: Here are the most common candlestick chart patterns in forex: However, before you can read and. Candlestick price action involves pinpointing where the price. Forex candlestick patterns are used by traders to identify trading opportunities and predict which direction the price will move in next. Bullish candlestick and bearish candlestick (with images).

From www.investopedia.com

Candlestick Definition Candlestick Meaning Forex Here are the most common candlestick chart patterns in forex: Forex candlestick patterns are used by traders to identify trading opportunities and predict which direction the price will move in next. Bullish candlestick and bearish candlestick (with images). Candlestick charts are a useful tool to better understand the price action and order flow in the forex market. The japanese candlestick. Candlestick Meaning Forex.

From nfljerseysfans.com

How to Read the Inverted Hammer Candlestick Pattern? (2022) Candlestick Meaning Forex Here are the most common candlestick chart patterns in forex: The good news is that japanese candlestick patterns clearly telegraph when currency trends are strengthening or. A candlestick chart is simply a chart composed of individual candles, which traders use to understand price action. However, before you can read and. Forex candlestick patterns are used by traders to identify trading. Candlestick Meaning Forex.

From www.pinterest.com

شمعات المطارق (Hammer candlestick patterns) هناك نوعان رئيسيان منها و Candlestick Meaning Forex Candlestick charts are a useful tool to better understand the price action and order flow in the forex market. Bullish candlestick and bearish candlestick (with images). Forex candlestick patterns are used by traders to identify trading opportunities and predict which direction the price will move in next. The good news is that japanese candlestick patterns clearly telegraph when currency trends. Candlestick Meaning Forex.

From www.strike.money

Candlesticks Definition, Origin, Parts, Patterns and What It Indicates? Candlestick Meaning Forex Candlestick charts are a useful tool to better understand the price action and order flow in the forex market. Bullish candlestick and bearish candlestick (with images). However, before you can read and. Forex candlestick patterns are used by traders to identify trading opportunities and predict which direction the price will move in next. Learn about all the trading candlestick patterns. Candlestick Meaning Forex.

From forexswingprofit.com

The Best And Accurate Forex Indicators On Earth Candlestick Meaning Forex Forex candlestick patterns are used by traders to identify trading opportunities and predict which direction the price will move in next. Here are the most common candlestick chart patterns in forex: Candlestick charts are a useful tool to better understand the price action and order flow in the forex market. Learn about all the trading candlestick patterns that exist: The. Candlestick Meaning Forex.

From creative-currency.org

Learn How to Read Forex Candlestick Charts Like a Pro Candlestick Meaning Forex Forex candlestick patterns are used by traders to identify trading opportunities and predict which direction the price will move in next. The good news is that japanese candlestick patterns clearly telegraph when currency trends are strengthening or. Bullish, bearish, reversal, continuation and indecision with. Learn about all the trading candlestick patterns that exist: Candlestick price action involves pinpointing where the. Candlestick Meaning Forex.

From blog.quantinsti.com

Candlestick patterns, anatomy and their significance Candlestick Meaning Forex Candlestick price action involves pinpointing where the price. Forex candlestick patterns are used by traders to identify trading opportunities and predict which direction the price will move in next. Learn about all the trading candlestick patterns that exist: Bullish candlestick and bearish candlestick (with images). However, before you can read and. Candlestick charts are a useful tool to better understand. Candlestick Meaning Forex.

From bloghowtotrade.blogspot.com

How To Trade Blog What Is Hammer Candlestick? 2 Ways To Trade Candlestick Meaning Forex However, before you can read and. The japanese candlestick chart is considered to be quite related to the bar chart. Bullish candlestick and bearish candlestick (with images). A candlestick chart is simply a chart composed of individual candles, which traders use to understand price action. Forex candlestick patterns are used by traders to identify trading opportunities and predict which direction. Candlestick Meaning Forex.

From browsespot.blogspot.com

Candlestick Patterns Every trader should know PART 1 Candlestick Meaning Forex Bullish, bearish, reversal, continuation and indecision with. Candlestick charts are a useful tool to better understand the price action and order flow in the forex market. Bullish candlestick and bearish candlestick (with images). Forex candlestick patterns are used by traders to identify trading opportunities and predict which direction the price will move in next. The good news is that japanese. Candlestick Meaning Forex.

From joon.co.ke

What Are Candlestick Patterns? Understanding Candlesticks Basics Candlestick Meaning Forex The japanese candlestick chart is considered to be quite related to the bar chart. Forex candlestick patterns are used by traders to identify trading opportunities and predict which direction the price will move in next. Bullish candlestick and bearish candlestick (with images). Candlestick price action involves pinpointing where the price. Here are the most common candlestick chart patterns in forex:. Candlestick Meaning Forex.

From www.pinterest.it

Candlesticks Candlestick Patterns This is All You Need To Candlestick Meaning Forex However, before you can read and. A candlestick chart is simply a chart composed of individual candles, which traders use to understand price action. Forex candlestick patterns are used by traders to identify trading opportunities and predict which direction the price will move in next. Here are the most common candlestick chart patterns in forex: The japanese candlestick chart is. Candlestick Meaning Forex.

From www.dailyfx.com

Forex Candlesticks A Complete Guide for Forex Traders Candlestick Meaning Forex Learn about all the trading candlestick patterns that exist: The japanese candlestick chart is considered to be quite related to the bar chart. Bullish candlestick and bearish candlestick (with images). The good news is that japanese candlestick patterns clearly telegraph when currency trends are strengthening or. Bullish, bearish, reversal, continuation and indecision with. Candlestick price action involves pinpointing where the. Candlestick Meaning Forex.

From forexboat.com

How to Trade the Hanging Man Candlestick ForexBoat Trading Academy Candlestick Meaning Forex Candlestick charts are a useful tool to better understand the price action and order flow in the forex market. However, before you can read and. A candlestick chart is simply a chart composed of individual candles, which traders use to understand price action. Here are the most common candlestick chart patterns in forex: Candlestick price action involves pinpointing where the. Candlestick Meaning Forex.

From www.earnforex.com

Forex Candlestick Patterns Cheat Sheet Candlestick Meaning Forex However, before you can read and. Forex candlestick patterns are used by traders to identify trading opportunities and predict which direction the price will move in next. Bullish, bearish, reversal, continuation and indecision with. The japanese candlestick chart is considered to be quite related to the bar chart. Candlestick price action involves pinpointing where the price. Here are the most. Candlestick Meaning Forex.

From www.andrewstradingchannel.com

Candlestick Patterns Explained with Examples NEED TO KNOW! Candlestick Meaning Forex Forex candlestick patterns are used by traders to identify trading opportunities and predict which direction the price will move in next. Bullish, bearish, reversal, continuation and indecision with. A candlestick chart is simply a chart composed of individual candles, which traders use to understand price action. The good news is that japanese candlestick patterns clearly telegraph when currency trends are. Candlestick Meaning Forex.

From www.investopedia.com

Understanding a Candlestick Chart Candlestick Meaning Forex Here are the most common candlestick chart patterns in forex: Bullish, bearish, reversal, continuation and indecision with. Candlestick price action involves pinpointing where the price. A candlestick chart is simply a chart composed of individual candles, which traders use to understand price action. Candlestick charts are a useful tool to better understand the price action and order flow in the. Candlestick Meaning Forex.

From learn.bybit.com

Hammer Candlestick What It Is and How to Spot Crypto Trend Reversals Candlestick Meaning Forex However, before you can read and. Candlestick charts are a useful tool to better understand the price action and order flow in the forex market. Bullish, bearish, reversal, continuation and indecision with. The japanese candlestick chart is considered to be quite related to the bar chart. Here are the most common candlestick chart patterns in forex: The good news is. Candlestick Meaning Forex.

From www.ig.com

What is a Candlestick in Trading? IG UK Candlestick Meaning Forex The good news is that japanese candlestick patterns clearly telegraph when currency trends are strengthening or. Learn about all the trading candlestick patterns that exist: Bullish candlestick and bearish candlestick (with images). A candlestick chart is simply a chart composed of individual candles, which traders use to understand price action. Candlestick charts are a useful tool to better understand the. Candlestick Meaning Forex.